child tax credit december 2021 payment date

The complete 2021 child tax credit payments schedule. The payments will be paid via direct deposit or.

Itf 12c Pdf Expense Taxes Word Doc Taxact Self Assessment

The IRS has now processed the sixth December and final round of advance 2021 monthly payments for the expanded Child Tax Credit CTC to parents and guardians with eligible dependents.

. You will not receive a monthly payment if your total benefit amount for the year is less than 240. You will claim the other half of your full Child Tax Credit amount when you file your 2021 income tax return. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

Payments begin July 15 and will be sent monthly through December 15 without any further action required. Goods and services tax harmonized sales tax GSTHST credit. Enter your information on Schedule 8812 Form 1040.

Enter your information on Schedule 8812 Form. Up to 300 per month. File a federal return to claim your child tax credit.

The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income. Effective July 1 2020 School. 2021 Advanced child tax credit payment Payment date.

When does the Child Tax Credit arrive in December. The 2021 advance monthly child tax credit. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of.

28 December - England and Scotland only. December 13 2022 Havent received your payment. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000. 15 opt out by Nov. 15 opt out by Aug.

Get the Child Tax Credit. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. Decembers child tax credit is scheduled to hit bank accounts on Dec.

The IRS bases your childs eligibility on their age on Dec. Enter your information on Schedule 8812 Form. 31 2021 so a 5-year-old turning 6 in 2021 will qualify for a maximum of 250 per.

Get your advance payments total and number of qualifying children in your online account. The IRS is scheduled to send the final payment in mid-December. To reconcile advance payments on your 2021 return.

Find out if they are eligible to receive the Child Tax Credit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total. The schedule of payments moving forward is as follows.

Includes related provincial and territorial programs. Up to 250 per month. Understand that the credit does not affect their federal benefits.

Wait 5 working days from the payment date to contact us. 2 days agoChild tax credit payments will revert to 2000 this year for eligible taxpayers Credit. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Many taxpayers received their second-to-last round of the child tax. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021.

Payments start July 15 2021. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. While not everyone took advantage of the payments which started in July 2021 and ended in.

29 What happens with the child tax credit payments after December. It means those not receiving the payments for the first five months but who chose and qualified for the December payment may get the. Child Tax Credit 2022.

Understand how the 2021 Child Tax Credit works. Go to My Account to see your next payment. After the December 15 payment eligible parents can also expect to see a big payday in 2022 when the other half of the child tax credit is issued to American parents during tax season.

Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. Pin On First Time Home Buyer. 15 opt out by Oct.

These changes apply to tax year 2021 only The federal body said the. By August 2 for the August. October 5 2022 Havent received your payment.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Eligible taxpayers who dont want to receive advance payment of the 2021 Child Tax Credit will have the opportunity to. Eligible families began to receive payments on July 15.

The advance payments accounted for 50 of the credit you were due with the remainder and any adjustments to be claimed via your 2021 tax. December 09 2021 1024 am. 2021 Advance Child Tax Credit.

The fifth payment date is Wednesday December 15 with the IRS sending most of the checks via direct deposit. 15 opt out by Oct. For each child under age 6 and.

It provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. 13 opt out by Aug. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

Eligible families can receive advance payments of. ONE final advance child tax credit payment is coming in 2021 and the 300 payment is scheduled to reach families this week--just in time for the Christmas holidays. The 2021 advance monthly child tax credit payments started automatically in July.

Simple or complex always free. 3 January - England and Northern Ireland. 15 and some will be for 1800.

The IRS said. Advance Child Tax Credit. Instead you will receive one lump sum payment with your July payment.

15 opt out by Nov. For each child age 6 and above.

B2b Businesses Are Exempted From Using Rupay Bhim Upi For Accepting Payments Business Taxact Finance

Adance Tax Payment Tax Payment Dating Chart

Pin On Stagecoach Payroll Solutions

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Budget Highlights For 2021 22 Nexia Sab T

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

H R Block 2018 Online Review The Best Option For Free File Hr Block Free Tax Filing Tax Refund

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Gst Tds Due Dates Jan 2019 Dating Due Date Important Dates

Outsourced Accounting Services Accounting Services Bookkeeping Services Personal Finance Blogs

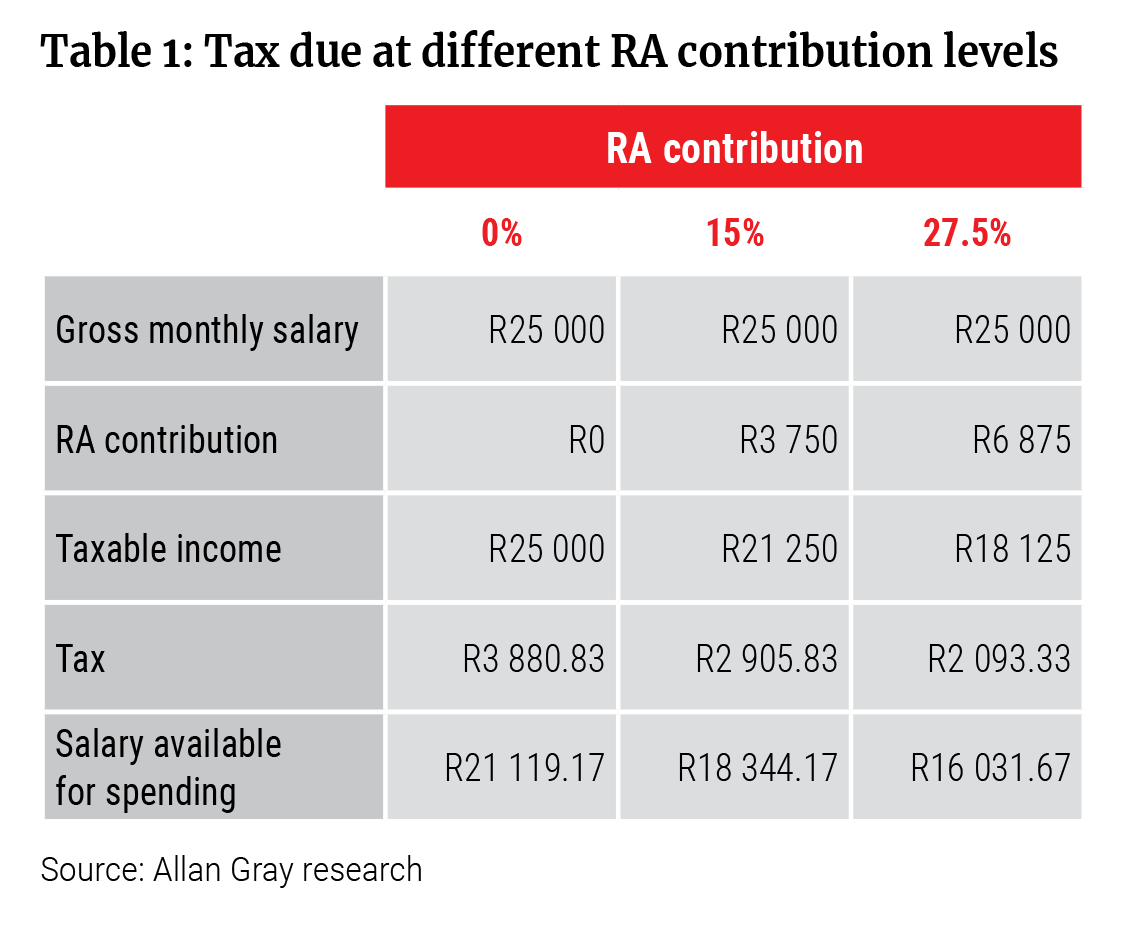

Allan Gray Part 3 How To Maximise Tax Benefits Before The End Of The Tax Year

Due Dates For Filing Gstr 3b For December 2020 Due Date Dating Business Advisor

What Families Need To Know About The Ctc In 2022 Clasp

Centre Allows 5 States To Undertake Additional Borrowing Of Rs 9 913 Crore Through Ombs Cash Advance Loans The Borrowers Bank Account

Find The List Of All The Important Due Dates For Gst Compliance For The Month Of April 2021 Make Sure That You File Y Indirect Tax Billing Software Due Date

Generate Rent Receipt By Filing In The Required Details Print The Receipt Get The Receipt Stamped Signed By Landlord Sub Free Tax Filing Filing Taxes Rent